If you own and occupy a home as your primary residence in Clark County, Nevada—whether it’s a single-family house, townhouse, condominium, or manufactured home—you are eligible for a 3% cap on your property taxes! However, your eligibility is verified by a postcard you receive in the mail. These postcards can be easily overlooked or you may mistake them as junk mail. Not replying to this postcard could lead to receiving a higher tax rate!

How to Verify Your 3% Tax Cap

There’s a quick and easy way to check if the 3% tax cap has been applied to your property:

- Visit the Clark County NV Treasurer’s website.

- Search for your property using your name, address, or parcel ID number.

- Find your property in the list and click on the Parcel ID.

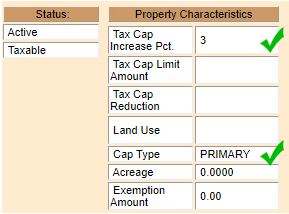

- Check your Tax Cap listed under Property Characteristics in the second section of the Summary. The Cap Type should be listed as Primary.

If your Property Characteristics show “3” and “PRIMARY,” you’re good to go! If these details are incorrect, contact the Clark County Assessor immediately at (702) 455-3882 to correct the issue.

Why This Matters

Residences not owner-occupied are subject to a cap of up to 8%. Incorrect categorization could result in significantly higher taxes. Additionally, if there have been changes to your property’s recorded deed—such as refinancing your mortgage, transferring the property into a trust, or a change of ownership—you need to complete a new postcard to retain your 3% abatement for the next fiscal year.

The Assessor’s Office mails new postcards after July 1 to properties with a change in document number or ownership during the fiscal year. However, it’s always safest to double-check your status online.

Key Dates and Additional Information

The fiscal year ends on June 30th. To avoid being locked into a higher tax rate for another year, verify your details on the Clark County Treasurer’s website as soon as possible. Note that some rental properties meeting low-income rent limits may also qualify for a 3% cap. New constructions or properties with a change of use do not qualify for any cap during the current fiscal year but will receive a cap of 3% or up to 8% starting the following fiscal year.

Who To Contact for Help

For any questions regarding your property taxes or the recorded summary of property characteristics, please contact the Clark County Assessor’s office at (702) 455-3882.

Stay informed and ensure you’re receiving the property tax benefits you’re entitled to!

To read more of the complete law passed by the Nevada State Legislature see NRS 361.4723.